The smart Trick of Bookkeeping Okc That Nobody is Discussing

Table of ContentsTaxes Okc Things To Know Before You BuyThe Definitive Guide to Okc Tax DeductionsCpa Okc - The FactsBusiness Consulting Okc Things To Know Before You Get ThisOkc Tax Credits - An OverviewTax Accountant Okc Things To Know Before You BuyThe Of Bookkeeping OkcThe Buzz on Real Estate Bookkeeping Okc

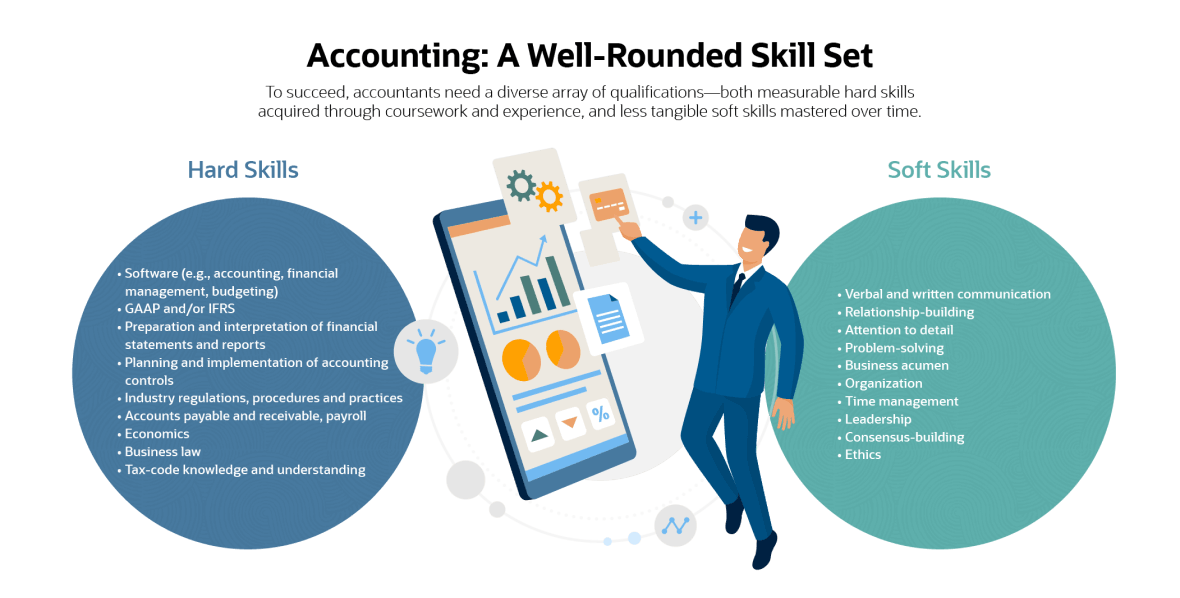

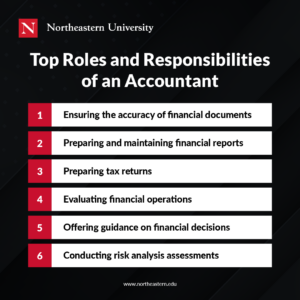

Due to the fast-paced and intricate nature of the modern-day organization world, employing expert accounting services is a needed part of conducting your business. Providers for little services and corporate accounting have shown needed throughout the years to assist organizations remain abreast of the law and weather condition periods of hardship.The team at F Silveira would like you to understand 6 things to think about when choosing an expert accounting partner (https://padlet.com/ivanbowden73105/p3-accounting-llc-lj146b37ba6zuopd). When selecting from accounting services, you need to consider a company with pertinent understanding in service, tax, and accounting. With that understanding, they can supply you with important information and essential recommendations

Experience in the field of accounting is also a fantastic step of a firm's ability. Finding an accounting firm that is always available when you require their services is essential.

Our Accounting Firm Okc PDFs

This helps you develop a strong relationship with your accountant which is necessary for you to trust them with your finances. accounting firm OKC. Spending for financial suggestions can produce an opportunity for more opportunistic and destructive individuals to benefit from you. For this reason, you should watch out for accounting services with outrageous fees.

Firms that are in advance and transparent about their rates design need to receive your consideration. A fantastic barometer of a company's efficiency is its social standing. That is identified by how customers speak about the company. Online reviews on websites like Yelp can assist determine a firm's track record.

Business Consulting Okc for Beginners

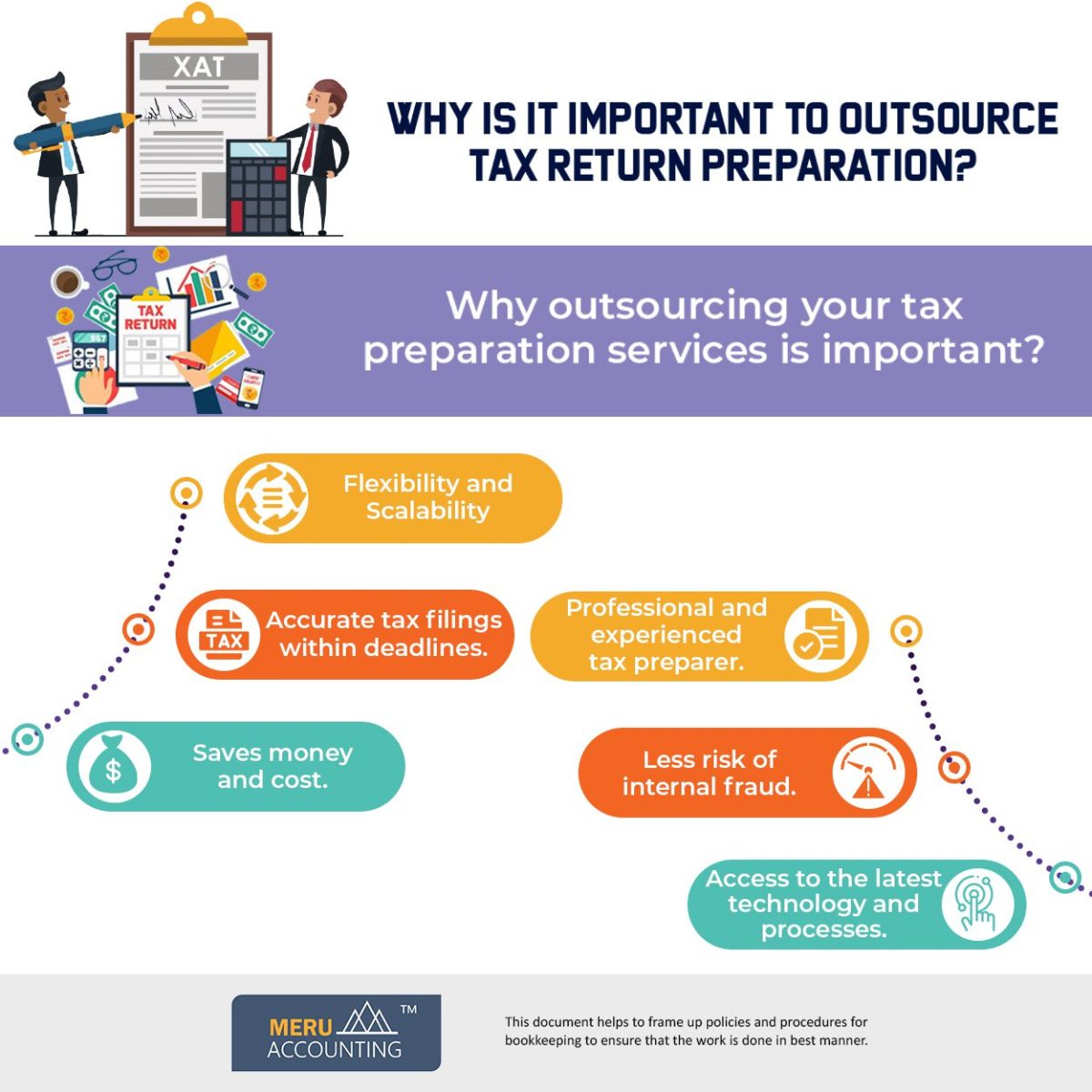

A firm with a wide range of faculties can provide you with many services in-house without the need to contract out any of your monetary work. Essentials like accounting, financial planning, and tax preparation are essential for a little company accounting service.

How some accounting services perform their service will likewise show how ideal they are for you. This could create variegated results for various people however taste matters too. Some may choose corporate accounting performed with the newest technology offered. An accounting company with this feature can move rapidly and commit less mistakes due to the automation of numerous tasks.

The smart Trick of Bookkeeping Okc That Nobody is Talking About

Our firm uses customized services to fulfill all your needs.

Things about Okc Tax Credits

Picking the right is a critical decision for organizations and people alike. Whether you need monetary assistance, tax preparation, or auditing services, picking the best accounting firm can considerably affect your financial success. This article will go over the crucial factors to consider when examining and choosing the very best accounting firm to satisfy your specific requirements.

The Definitive Guide to Okc Tax Credits

An enduring and positive credibility is a good sign of a reliable accounting partner. Certifications and Accreditations: Make sure that the firm's accountants and specialists are qualified and accredited. Certified Public Accountants (CPAs), Chartered Accountants (CA), or other appropriate certifications show a dedication to high expert requirements and principles. These qualifications are especially important when looking for services associated with taxes and monetary compliance.

Communication and Accessibility: Effective interaction is essential when working with an accounting firm. Understand the cost structure discover this info here of the accounting firm.

The Ultimate Guide To Taxes Okc

Transparent pricing and a clear understanding of how you will be billed can help you avoid unanticipated expenses. OKC tax deductions. Think about the size of the accounting company and how it might impact your experience - https://sketchfab.com/p3accounting. Bigger firms may offer a more comprehensive variety of services and know-how but can often lack a personal touch

Select a firm that lines up with your preferences. Place and Availability: If you choose face-to-face meetings, think about the place of the accounting company. Proximity can be essential, particularly if you need to visit their workplace routinely. However, in the age of remote work, many companies use online services that make place less crucial.

Little Known Facts About Tax Accountant Okc.

Evaluating real-life examples of their work can give you a better understanding of their abilities and how they can add worth to your monetary situation. Picking the very best accounting firm is a choice that ought to not be ignored. Consider the aspects talked about in this post to make an informed option that aligns with your specific financial requirements and goals.

As a company owner, you understand the ins and outs of your industry. That stated, you'll also require the financial expertise to ensure your company is established for financial durability - business consulting OKC. That's why discovering the ideal accounting firm can make all the difference in making certain your company's cash is managed well, lessening your tax concern, and beyond